Page 1

LILAC Document Help

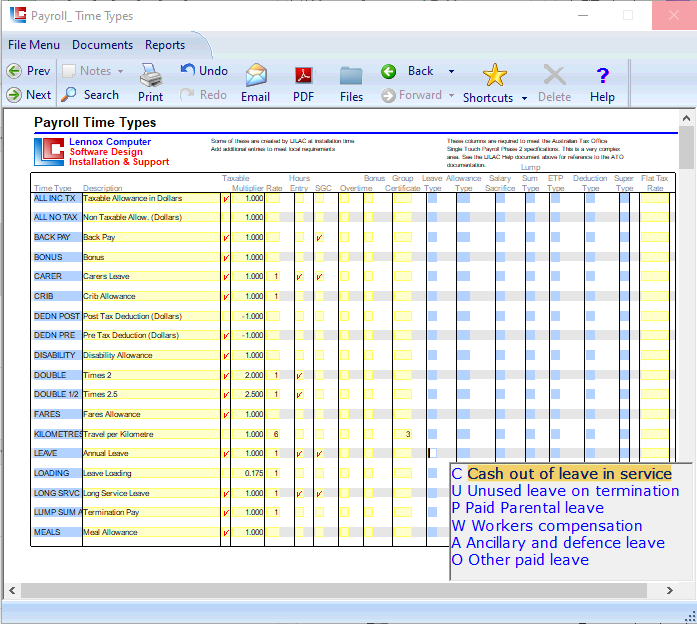

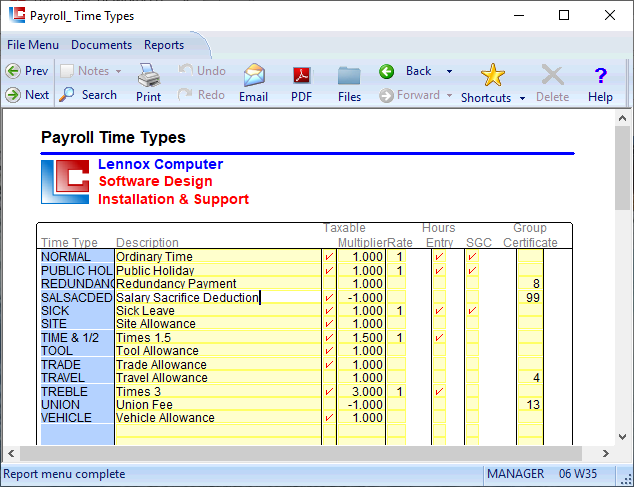

Payroll Time Types

Time Type settings are used in the Type column of Pay Cycle tables at: Document > Payroll > Paysilp

Time Types should have appropriate columns activated for Single Touch Payroll Reporting

Taxable: Is taxable Tick/Untick

Multiplier: E.g. NORMAL = 1, 38 hours = 38 hours. TIME & 1/2 = 1.5, 2 hours = 3 hours.

Rate: Zero (blank) = Dollar Entry. A value of 1-12 will use Pay Rate 1-12 from the Pay Slip.

Hours Entry: This Time Type is in hours (Quantity in the Pay Cycle Tables).

SGC: Include in Super Guarantee Contribution calculation.

Overtime: Time Type is classified as Overtime.

Bonus: Bonus or Directors Fee.

Group Certificate: Location of Group Certificate

A Time Type should only ever have a maximum of one option selected from the blue fields listed below. (Often no options selected from the blue fields is appropriate).

Leave Type: Paid Leave

Allowance Type: Allowances

Salary Sacrifice: Salary Sacrifice

Lump Sum Type: Lump Sum Payments

ETP (Employment Termination Payments) Type

Deduction Type: Tax Deductions such as Union Fees and Child Support

Super Type: Contribution payable by a payer for the benefit of a payee

Flat Tax Rate: A tax rate that will override normal Tax Scale calculations. Eg one off Lump Sum payments. Where such a Time Type is used in a Pay Slip, the 'Tax Calculator' button from the Pay Slip ribbon may be used to calculate a separate Tax Override figure for such a Time Type.

Multiplier: E.g. NORMAL = 1, 38 hours = 38 hours. TIME & 1/2 = 1.5, 2 hours = 3 hours.

Rate: Zero (blank) = Dollar Entry. A value of 1-12 will use Pay Rate 1-12 from the Pay Slip.

Hours Entry: This Time Type is in hours (Quantity in the Pay Cycle Tables).

SGC: Include in Super Guarantee Contribution calculation.

Overtime: Time Type is classified as Overtime.

Bonus: Bonus or Directors Fee.

Group Certificate: Location of Group Certificate

A Time Type should only ever have a maximum of one option selected from the blue fields listed below. (Often no options selected from the blue fields is appropriate).

Leave Type: Paid Leave

Allowance Type: Allowances

Salary Sacrifice: Salary Sacrifice

Lump Sum Type: Lump Sum Payments

ETP (Employment Termination Payments) Type

Deduction Type: Tax Deductions such as Union Fees and Child Support

Super Type: Contribution payable by a payer for the benefit of a payee

Flat Tax Rate: A tax rate that will override normal Tax Scale calculations. Eg one off Lump Sum payments. Where such a Time Type is used in a Pay Slip, the 'Tax Calculator' button from the Pay Slip ribbon may be used to calculate a separate Tax Override figure for such a Time Type.

Help Page: Payroll > Single Touch Settings